They say getting that first million savings is the hardest. And once you get there, growing it can be easier than you thought it would be. Well, it may be true in some cases but first, let's try to get there with concrete and practical computations.

|

| 1 million savings |

If this is not on your bucket list, then most people consider this a milestone in life. Why not, right? The effort behind getting this specific amount can be daunting so it's really something to celebrate. Many people won't even get the chance to reach it in their whole lifetime so appreciating this kind of breakthrough is something to value.

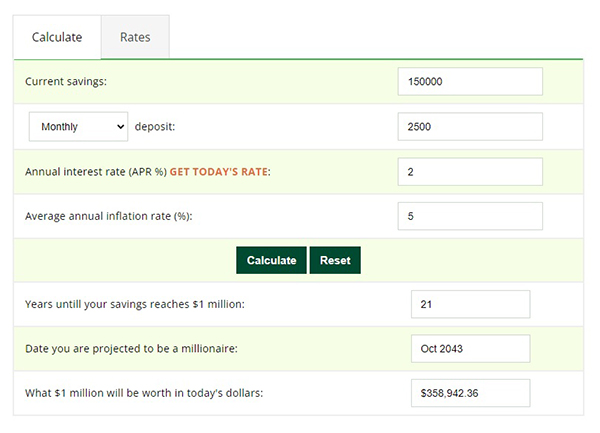

You can actually use this millionaire calculator for some aid to get that practical computation. What I like about this calculator is the speed, convenience, and user-friendliness of the site. It is so simple to use and every factor is already given. All you need to do is to fill in the numbers and with one click, you get your answers.

Important legends are as follows:

- current savings amount

- annual interest rate (APR%)

- average annual inflation rate

Once you have this data, simply click "calculate" then it will give you 3 specific pieces of information answering when & what: When will you reach getting that first million savings, and what's it worth by that time..

For this example, I inputted of having a $150,000 current savings (currency is just a symbol here as it is practical to any), a $2,500 monthly deposit, a 2% annual interest rate, and an average of 5% inflation rate.

|

| sample millionaire calculator |

With the given details, it gave results of achieving the first million after 21 years which is by October 2043 with worth amounting to only around $350,000 (potential buying power) by that time.

And knowing facts like this will make one adjust and rethink more possibilities to make it happen sooner. The low-interest rate in banks and the rising inflation rate due to the pandemic is slowly devaluing all savings so actions must be urgently done. Increasing the monthly savings, investing the current savings into some higher-yielding schemes, or starting a business that will produce more profit than the annual interest rate in banks are some of the possible options one can make.

For some experienced tips, Chinkee Tan, one of the most popular financial consultants & business coaches here in the country, has a website that has helpful tips about saving, budgeting, and investing. Feel free to check his site out.

One of the simple things I heard from one of his YouTube videos is avoiding the use of credit cards - pay in cash as much as possible. But for some inevitable cases, pay the credit card dues on time because the interest rates are compounding. You can try to sample compute using this credit card payment calculator. This site actually has a lot of financial-related calculators including calculators for loans, budget planning, and investing so make sure to explore them more. I find their loan calculator very helpful for those who have existing ones but it's always better if you have none, right?

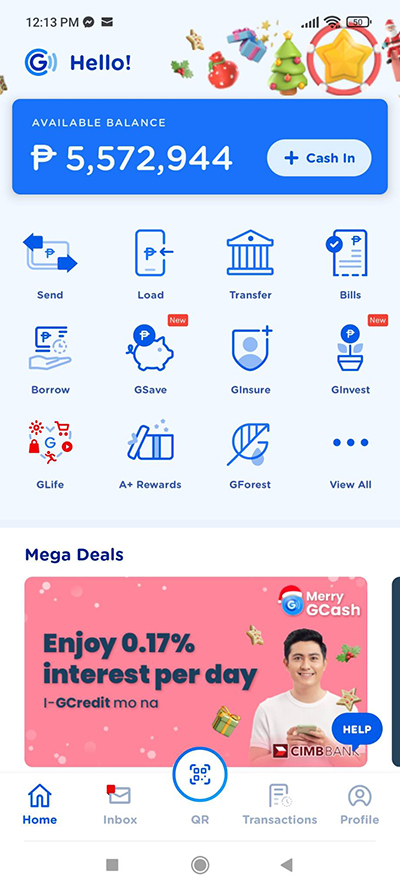

|

| million savings in mobile wallet |

So, are you ready to compute your first million savings and know when you might get it?

I actually agree that getting your first million is the hardest because it is the phase where you are really challenged with limited knowledge, problem-solving ideas, network, and of course, experience. You grow all of these as time passes by and you should have learned what skills, practices, and techniques work for you in achieving that million goal. From there, applying those systems that work and doing those favorable habits and practices should work effortlessly getting you more than that million goal.

For fun's sake, can you comment down below what year will you get your first million using this millionaire calculator? I am so curious to know!

First (1) million savings | Let's calculate

Reviewed by Michael

on

January 05, 2023

Rating:

Reviewed by Michael

on

January 05, 2023

Rating:

Reviewed by Michael

on

January 05, 2023

Rating:

Reviewed by Michael

on

January 05, 2023

Rating:

Ohhh,thanks for sharing this♥️

ReplyDeleteThat is so so cool! I love the calculator, it is wonderful! Thank you so much....

ReplyDeleteThis is a neat idea. It is a good reference to see how much you could potentially save!

ReplyDeleteI'm sorry, but it's not my goal. Money can't buy you happiness.

ReplyDeleteI love this, shows that anyone could be a millionaire if we just learn to budget and save better.

ReplyDeleteLooks like a very handy tool! I definitely should look into savings more Lyosha

ReplyDeleteSo bad. I will become a millionaire in 2091 and by the time I am already 6 feet below the ground. I wish to get it before my time ends.

ReplyDeleteThat's a good way to motivate oneself when you save. Personally, I'm the type that likes to see how I'm going with my goals. my bank app has something like this, but more specific on goals..like if you want to travel or if you are saving for education...

ReplyDeleteIpon Goals now 2023. Thank you for sharing this

ReplyDeleteThank you for sharing sir michael laking tulong nito

ReplyDelete