I have a specific amount in my bank account right now that is just literally sitting there for years because I don't know what to do with them, yet. But is it the right thing to do? Is there any other way to save more funds proficiently? Well, it's always good to have something stored especially when it comes to money but it's not necessarily always the best scenario. Let me show you here why.

|

| savings vs inflation |

Since COVID-19 lockdowns start to happen and inflation rose, some effects of it might not be instant but I guess after a few years that have already gone by, we are now starting to feel its effects. One of which is the rising prices of goods hence the general cost of living increases accordingly.

A good simple illustration here to estimate our savings value over time is using this online calculator I recently stumbled upon. It made me see what's my savings worth after a few years in one click and it's really an eye-opener.

For this illustration, let me give the following details:

For example, I have a savings amount of P100,000 in the bank with an annual interest rate (APR%) of 0.25. Let's say I will just freeze it there after 3 years and will just live off my current salary without saving anything. Currently, our inflation rate is at 7% but just for the sake of this example, let's put it at an average of 5% for the 3 given years.

|

| savings calculator input |

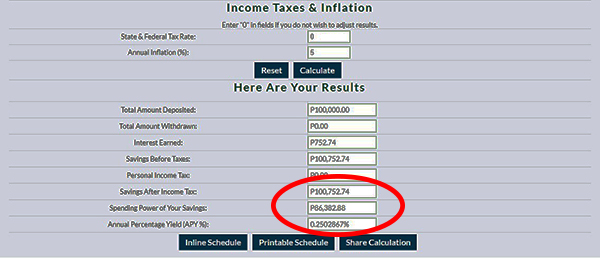

In just one click after inputting all the details, it gave me the value that I am looking for. And it was not a good sight to see.

|

| savings calculator result |

With the low-interest rate in banks, the inflation rate ate it all up and ended at P86,382.88 spending power after 3 years. This means that my P100,000 will be P100,752.74 in bank figures but it's only worth P86,382.88 in reality because the prices of the goods rose. It's nearly 15% less than what it was before so it will still go lower if left untouched or stagnant.

So what should we do?

We actually have no choice but to grow it continuously. I am not saying that we should use all of it because having a safety or emergency fund is a must too, but just make sure to have the effort to increase it over time. Some of the options can be investing in high-yielding bonds/stocks (that can keep up with the inflation) or maybe starting some business that you can later on grow.. Every venture has risks and even doing nothing has its consequences so as they say, pick your poison.

|

| are you really saving enough? |

With this revelation, I think planning my retirement funds should come next especially now that I am in my career-building stage in life - where I can still aggressively risk & save. Well, it can be too early for some but knowing how much should I earn, save, and expect in the future is just being responsible so I will not be depending on others when the time comes.

To be honest, I was just saving, saving, and saving from the start not knowing what to do with it. Now, with more learning about interest rates and inflation, achieving a specific amount of funds for a planned life such as retirement feels more defined and purposeful.

So, I have to ask again. Are you saving enough for your future?

Are you saving enough for your future?

Reviewed by Michael

on

December 20, 2022

Rating:

Reviewed by Michael

on

December 20, 2022

Rating:

Reviewed by Michael

on

December 20, 2022

Rating:

Reviewed by Michael

on

December 20, 2022

Rating:

Covid and paeng left us nothing, we opted to save as much as possible, this really into consideration

ReplyDeleteThank you for sharing this!but honestly po hindi enough ang kita para maka pag save but ika nga kahit maliit meron pa din po

ReplyDeleteThank you for sharing po

ReplyDeleteWorth it to read pero sana all may nasave na money sa bank

Btw,to be honest,maganda naman ung may naipon

At kahit papano ,magagamit din natin ito in the future

Thanks for sharing this , napaisip tlga ako bigla oo nga hndi sapat ung ipon at kita parang sa png araw araw lang kulang pa . Kaya dapat kayod kung kaya ng doble triple gawin na kse hndi ntin masasabi tlga ang panahon lalo na pag my emergency

ReplyDeleteThanks for sharing this po very helpful po ito to know how to save money for our future po dahil it's very important talaga 🥰

ReplyDelete